Inheritance

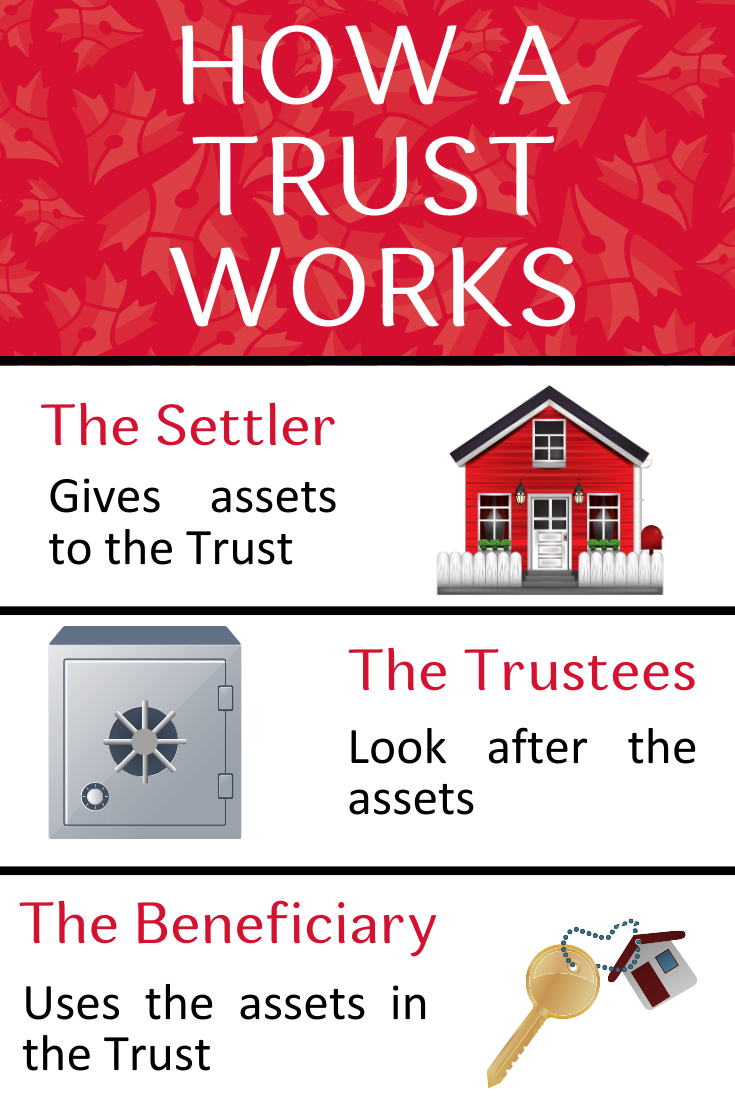

When you pass away your spouse and/or children would be beneficiaries of the trust. Which would mean they would be able to live in the house without needing to own it. If your spouse re-marries and then passes away your house does not pass in ownership to the new spouse, it does not become part of their estate. When your children become beneficiaries they would not need to pay 40% inheritance tax on the house, often leading to the property being sold to cover costs.